Blog post

Why We Added PPP Data to Our Fraud Investigation Tool

Max Blumenfeld, Co-Founder, COO and Head of R&D

Published

May 19, 2023

How PPP data could help financial institutions to fight fraud

By now, most know the story: in the rush to get funds to struggling businesses during the pandemic, federal stimulus programs sacrificed fraud protection and identity verification for the sake of speed. While the vast majority of PPP (Paycheck Protection Program) loans were made by legitimate financial institutions to legitimate businesses in need and helped protect the livelihoods of these business owners and their families, due to the scale of the program, the amount of fraud that did occur resulted in tens of billions of taxpayer dollars lost. At SentiLink, we've recognized another reality: the repository of publicly available PPP loan data offers insights into millions of cases of fraud.

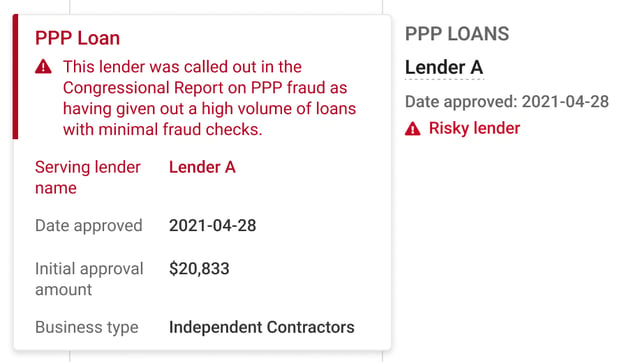

That's why we're excited to announce that this quarter, users of our fraud investigation tool, known as the Dashboard, will be able to see which individuals received PPP loans, along with those who received loans from the five problematic lenders called out by the House Select Subcommittee on the Coronavirus Crisis report1 as having very lax fraud controls. We can also return signals via API on whether an individual has been tied to a PPP loan and metadata about the loan or as part of backfills.

Screenshot from SentiLink’s Dashboard, showing an individual who received a PPP loan from a lender called out in the Congressional Report on PPP Fraud.

What we did

The PPP data is publicly available via a FOIA request2. In many instances, individuals applied for loans using their own name in place of a business name along with their own address. In such cases, we merged these PPP loans into Manifest, our linked and organized view of consumer identities, linking only where we could find a unique identity that matched the name and address on the PPP loan exactly. This let us build a repository of individuals who received such loans, with minimal false positives.

Why we did this

Last year, several partners alerted us to what we realized was a shared problem: Significant increases in first party fraud on demand deposit accounts (DDAs), especially check fraud. Individuals participating in such schemes were driving, in some cases, tens of millions in losses per month for individual institutions.

As our fraud analysts manually investigated these cases, we discovered something striking: Many of these individuals had posed as small businesses to acquire PPP loans from the lenders cited in the Congressional Report. When our fraud analysts looked deeper, they often found no proof that these businesses ever existed, whereas for nearly all legitimate small businesses, some sign of life exists online.

Industry experts familiar with check fraud have supported these findings: A report from the International Association of Financial Crimes Investigators3 specifically noted that similar networks of individuals committing check fraud schemes (who often have ties to criminal organizations) were also recruiting individuals to apply for fraudulent PPP loans. The Congressional report cited above corroborates that criminal gangs were active in recruiting individuals to apply for loans.

Finally, the accurate repository of PPP data in addition to fraud labels we’ve received from our partners, has let us quantify what we suspected all along: Individuals who received PPP loans from these five lenders account for roughly 13% of instances of check fraud, compared to just ~3% of general applications for checking accounts. In some more targeted fraud rings, we have seen that as many as 25% of involved individuals received these loans.

Conclusion

While the dust is still settling and misappropriated PPP funds are still being tracked down, we're excited to have found a way to use this data to provide value to the financial services industry, both in terms of stopping more fraud and giving financial institutions a deeper understanding of who they are doing business with.

For more information on how PPP data could enhance your view of your customers you can reach us here.

________________________________________

1"'We are Not The Fraud Police': How Fintechs Facilitated Fraud in the Paycheck Protection Program." Staff Report of the Select Subcommittee on the Coronavirus Crisis. December 2022.

2Available at: https://data.sba.gov/dataset/ppp-foia

3"'Crackin' Cards' 101: A Guide for the Investigator and the Street Officer." International Association of Financial Crimes Investigators, July 2021. https://www.iafci.org.

Max Blumenfeld is Co-founder and COO of SentiLink. Prior to SentiLink, Max led Risk Operations and Fraud Data Science at Affirm. Max holds a degree in mathematics and economics from the University of Chicago and was named to Forbes’ 30 Under 30 list in 2020.

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024