Blog post

Tradelines Being Shut Down By The Bureaus

Max Blumenfeld, Co-Founder, COO and Head of R&D

Published

July 23, 2021

Ever wonder who is MAJR Financial when looking at someone’s credit report? They are a company called My Jewelers Club and are one of several companies like them being shut down by the credit bureaus.

My Jeweler’s Club appears to be an online jewelry store, but they are really a non-reputable credit repair agency offering consumers and criminals the ability to buy credit lines - and almost 4% of credit active consumers have a MAJR Financial tradeline.

For $99, anyone could get a $5,000 unsecured line furnished to their credit report. They’re categorized as a charge account just like a card from Kay Jewelers (issued by Comenity) or Amazon (issued by Synchrony). Except there’s no partner bank, no real credit evaluation done on anyone that applies at My Jeweler’s Club.

My Jewelers Club and companies like them are simply used to boost credit scores and effectively mask creditworthiness of consumers. They are also used by fraudsters with synthetic identities to increase credit scores of these fake people.

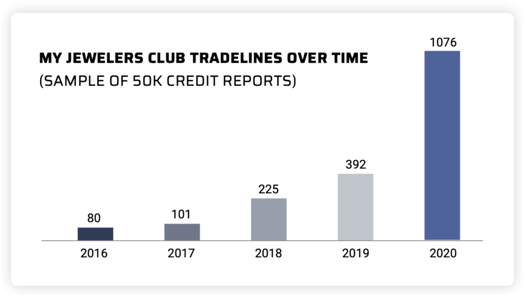

While it appears the bureaus have stopped accepting tradelines from My Jewelers Club, many took advantage of the ability to buy tradelines from them in recent years. We sampled just 50K credit reports in 2021 and found a significant increase in MAJR Financial tradelines over time.

There are a host of companies that offer tradelines for sale. Many are disguised as online retailers. In addition to My Jeweler’s Club, the following companies are now prevented from reporting to the bureaus.

- Newcoast Direct

- Hutton Chase and Ox Publishing (managed by same team)

- Drinkstill.com

- Shop Simplio

AG Jewelers is similar to the companies above, and appears to still be accepting applications for credit, but they no longer mention at their website that they report tradelines to the bureaus. AG Jewelers charges $149 for a $10,000 credit limit and also requires a $99 annual fee. However, they admit at the website they won’t do a “hard or a soft credit bureau pull” and also mention, “you are not required to purchase jewelry” to apply for the tradeline. However, it’s likely the bureaus have stopped accepting tradlines from AG Jewelers as well.

These are significant changes that will help lenders who depend on bureau data to accurately underwrite consumers. It will lead to better pricing and risk management overall.

________________________

MESSAGES ON WEBSITES

"Despite our best efforts, it appears that the Credit Bureaus are no longer interested in working with credit building companies like Hutton Chase. I have given my full attention for the past four years to ensure I am doing all that the bureaus require regarding compliance.

The Hutton Chase staff is truly committed to helping the underserved consumer reach their goals. That said, I am excited about a new avenue that I hope to reveal in the 4th quarter of this year. My expectation is to help you gain a better place in the credit arena. It may not look the same, but we must adapt to the circumstances beyond our control. Please know that Hutton Chase is on the consumer's side and believes you should you should be able to utilize every avenue to better your credit.

Thank you for your continued patronage and patience.

Options until more comes: https://www.creditbuildercard.com/huttonchase.html.

#TeamCreditBuild

Best Regards,

Mitzi Pate, CEO

Due to the volume of messages, there may be a delay in response. Our website is currently down and we are not accepting new clients during this time. We value our clients here at Ox Publishing. Thank you for your continued support.

Sincerest Regards,

Mitzi Pate, CEO

Newcoast Direct is currently not accepting new credit applications.

My Jewelers Club is not accepting new credit applications at this time.

Currently all spots are full. Register to be notified when more spots open up.

________________________________________

Max Blumenfeld is Co-founder and COO of SentiLink. Prior to SentiLink, Max led Risk Operations and Fraud Data Science at Affirm. Max holds a degree in mathematics and economics from the University of Chicago and was named to Forbes’ 30 Under 30 list in 2020.

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024