Blog post

The CARES Act: An Unfortunately Good Opportunity For Bad Actors

Vivek Ahuja

Published

April 3, 2020

With nearly $350 Billion earmarked for small businesses under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), SBA lenders will need fast and intelligent decision-making in order to get these funds into the hands of legitimate small businesses and out of the hands of criminals and bad actors who are looking to steal this money from taxpayers.

At SentiLink, we believe that most sophisticated SMB lenders have already started to anticipate some of the synthetic fraud challenges that may be coming soon, but there are also those who may not quite be operationally ready to handle the influx in loan applications.

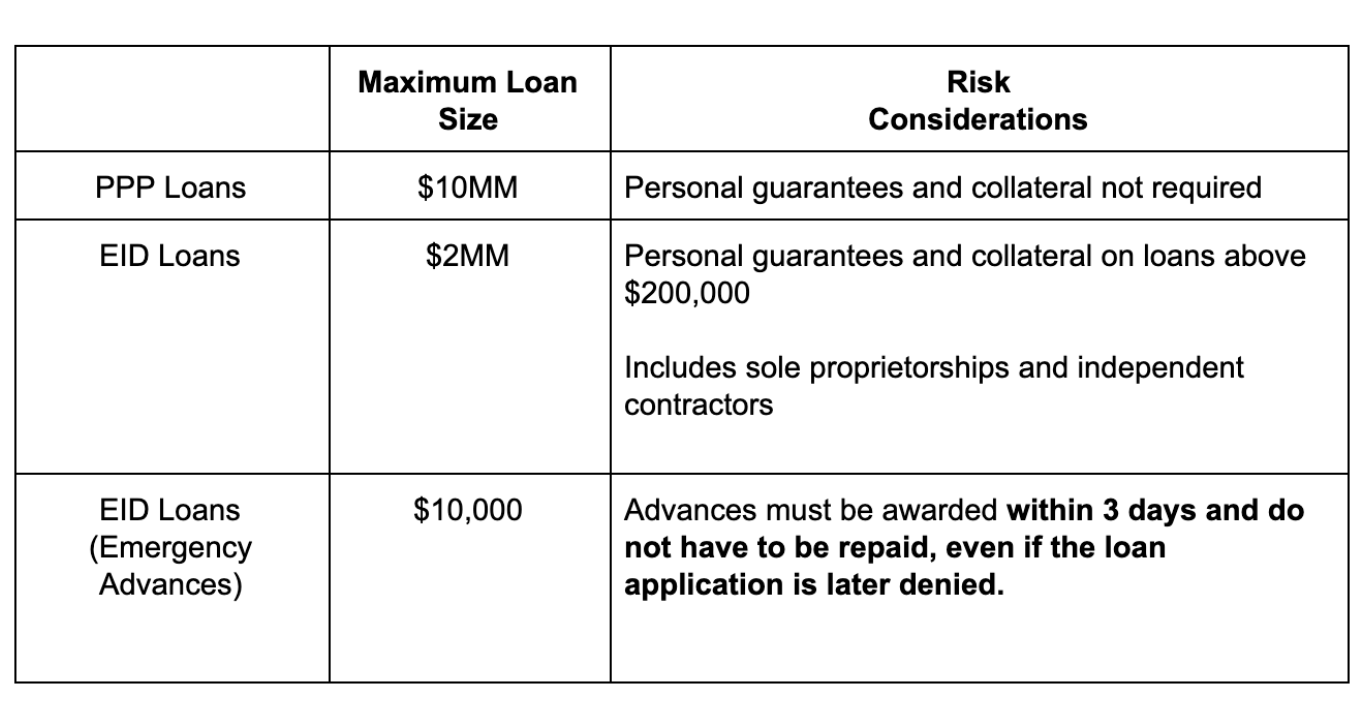

As risk managers, a few things stand out to us when reviewing the updated guidance from the SBA regarding updates to SBA Program 7(a) “Paycheck Protection Program” (“PPP”) Loans and SBA 7(b) “Economic Injury Disaster” (“EID”) Loans. :

This is an ideal environment for fraudsters to use synthetic business entities and synthetic beneficial owners to apply for these financial products:

- SMB demand for these new lending options will be high, and SMB lenders are also looking for ways to grow their origination volumes while mitigating risk.

- Lenders have little incentive to enforce strong underwriting standards as they bear little risk of loss — they can collect processing fees of 1%-5%, the loans are backed by the federal government, and can be sold in secondary markets.

- The qualification standards have been expanded to SMB segments which are more difficult to verify.

- Recourse is almost non-existent when a loan has been provided to a synthetic identity.

Within SMB online lending, we normally estimate that between 60bps-150bps of applications comes from synthetic identities. For loans originated through the recent SBA program expansion, we anticipate the application fraud rates here will be even higher, and would not be surprised to see application fraud rates in excess of 300bps-500bps, resulting in the very real possibility of public funds being directed to fraudsters on the order of $10B -$20B, on top of the billions in processing fees that will go to lenders that originate these loans.

If you are an SMB lender looking for a way to speed up and improve your detection of fraudulent loan applications, please contact info@sentilink.com

For official information on the CARES Act, we recommend checking out:

US Senate Guide to the CARES Act

PPP Fact Sheet from the US Treasury

US Small Business Administration

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024