Blog post

Synthetic Fraud and Credit Repair Agencies

Sarah Hoisington

Published

September 22, 2020

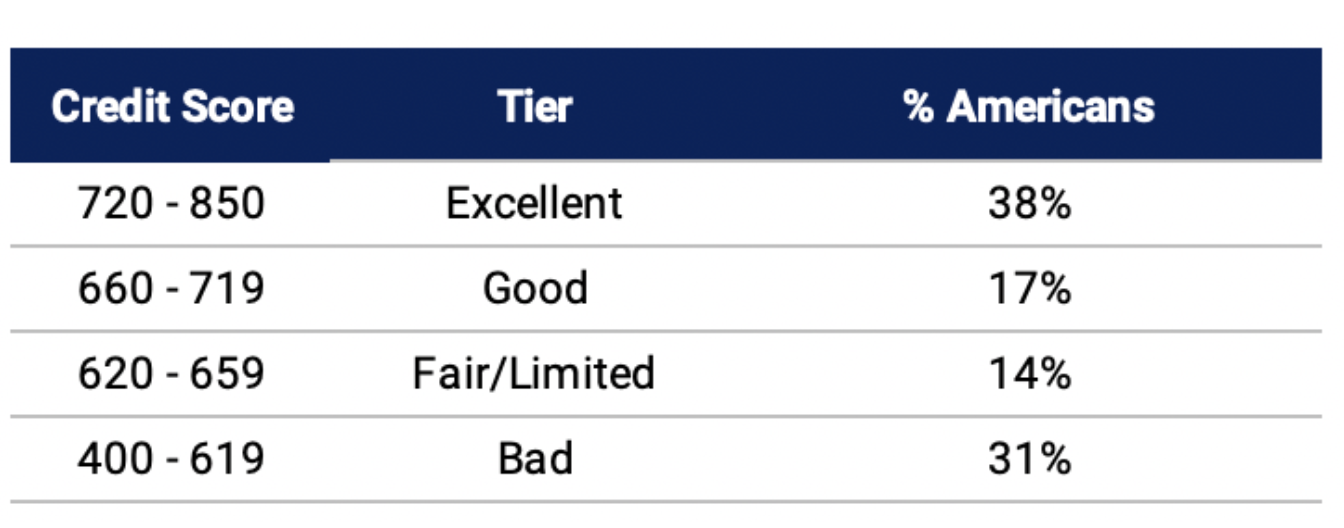

A strong credit score in the U.S. is valuable currency. Credit scores vary from 350 to 850 and are supposed to be a reflection of a consumer’s financial responsibility. With a 700 or higher score, it’s easy to rent an apartment, get an unsecured credit card with reasonable interest rates, or be approved for a mortgage. Banks and lenders view consumers with high credit scores as trustworthy; they can be relied upon to repay a loan.

The average credit score in the U.S. is 703 based on the Fair Isaac Corporation (FICO). While a credit score of 700 or above is viewed positively by most banks and lenders, a score of below 660 may prevent consumers from getting the credit they want or need.

According to WalletHub, 45% of Americans have a credit score that could be described as Bad, Fair or Limited. That’s approximately 90MM people with less than ideal credit.

An entire industry has been created to help Americans repair and enhance their credit score. Many U.S. consumers have used these companies to legitimately raise their score. However, a handful of non-reputable credit repair agencies with limited identity verification controls are also targeted by synthetic fraudsters looking to build credit histories quickly.

Credit Score Basics

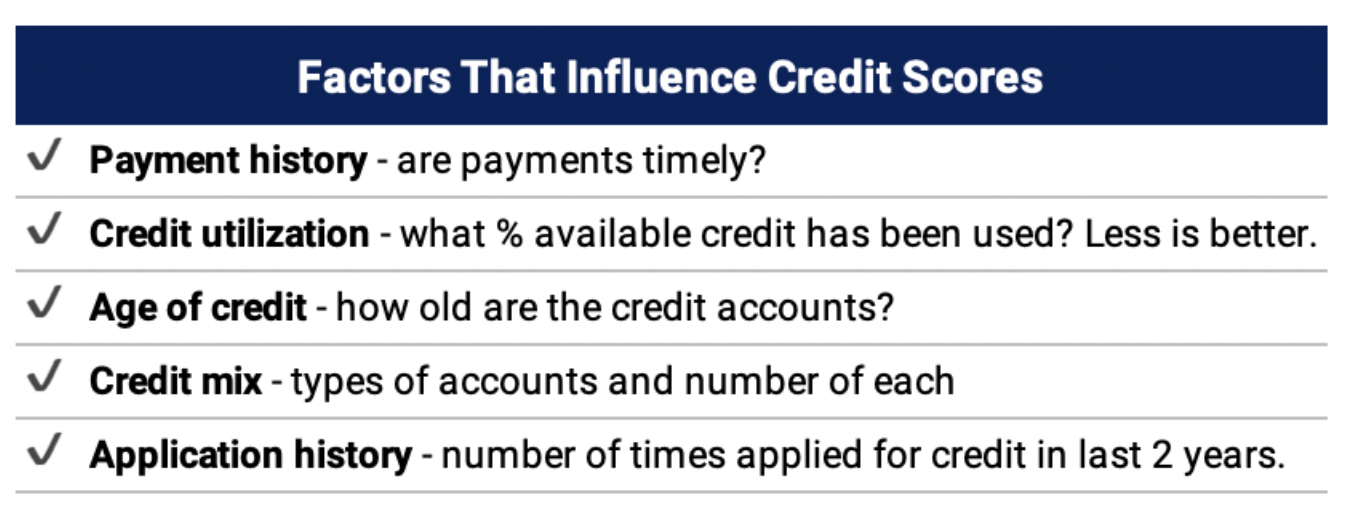

To appreciate how credit repair companies work, it’s necessary to understand how credit scores are calculated. There are five factors that influence credit bureau scores:

Time is the main ingredient in building credit. It can take years to accumulate a strong payment history and to have credit for a long enough time that the “age of credit” contributes positively to the credit score calculation.

There are shortcuts, however. The quickest way to improve a credit score is to focus on credit utilization and to increase the number of tradelines, which positively impacts the credit mix consideration. Some credit repair companies leverage these shortcuts to help real people and synthetic identities improve their credit score.

Synthetic Identities — Accelerate the “Build” with Credit Repair

Synthetic identities are combinations of names, dates of birth and social security numbers that don’t correspond to real people.

There are 3 stages to synthetic identity fraud — create, build and bust out.

- Create — A synthetic identity is created when a credit file is established at a credit bureau with a name, date of birth and social security number combination that’s not associated with any real person.

- Build — Once the credit file of a synthetic identity is established, fraudsters build the credit history and worthiness of the identity. They can do this by applying for small loans and credit cards that they use and pay off — and gradually increase the loan size and credit limit they are able to access. It can take years to season an identity before it is approved for a $20K+ unsecured loan or line of credit.

- Bust Out — Once the credit score of a synthetic identity is high enough, fraudsters bust out. They typically take out multiple large loans and then disappear with no intention to repay.

Fraudsters can accelerate the “build” process by leveraging the credit repair companies who approve applicants for large unsecured loans without requiring stringent verification. This enables them to significantly improve their credit utilization and add another tradeline to their credit report. Both factors enhance the credit score of the fraudster’s synthetic identities.

Credit Repair Companies Targeted By Synthetic Identity Fraudsters

Credit repair companies have the potential to legitimately educate U.S. consumers and provide tools to improve their creditworthiness. Those that don’t have strong KYC checks or those who promote illegal methods to boost credit scores (e.g. CPNs), are sometimes referred to as non-reputable credit repair agencies. They tend to attract fraudsters with synthetic identities.

Consider the example of credit repair companies who, on the surface, appear to be online retailers. They have websites that feature a variety of goods for sale. It’s only when consumers add items to their cart and begin to check out are they encouraged to submit a credit application. In reality, this is a credit repair company used by consumers and probably fraudsters to add a tradeline to their credit report. Customers are required to buy an item worth at least $100 and, in return, nearly all are approved for a $5,000 unsecured credit line. Many of these credit repair companies advertise over 90% approval rates regardless of credit history.

This easy-to-get $5,000 unsecured credit line is why these types of credit repair companies are attractive to fraudsters who want to quickly build the credit worthiness of a synthetic identity. Any new identity that has just been created at the credit bureau is limited in both the type and the size of credit they can expect to receive. Neither traditional nor fintech lenders would approve anyone new to credit for a $5,000 unsecured credit line. Without any payment history to gauge creditworthiness, most new identities are limited to a small secured line of credit. However, if a fraudster can create a synthetic identity and immediately get a $5,000 unsecured line of credit, they have significantly accelerated the time to “bust out.”

SentiLink Insight

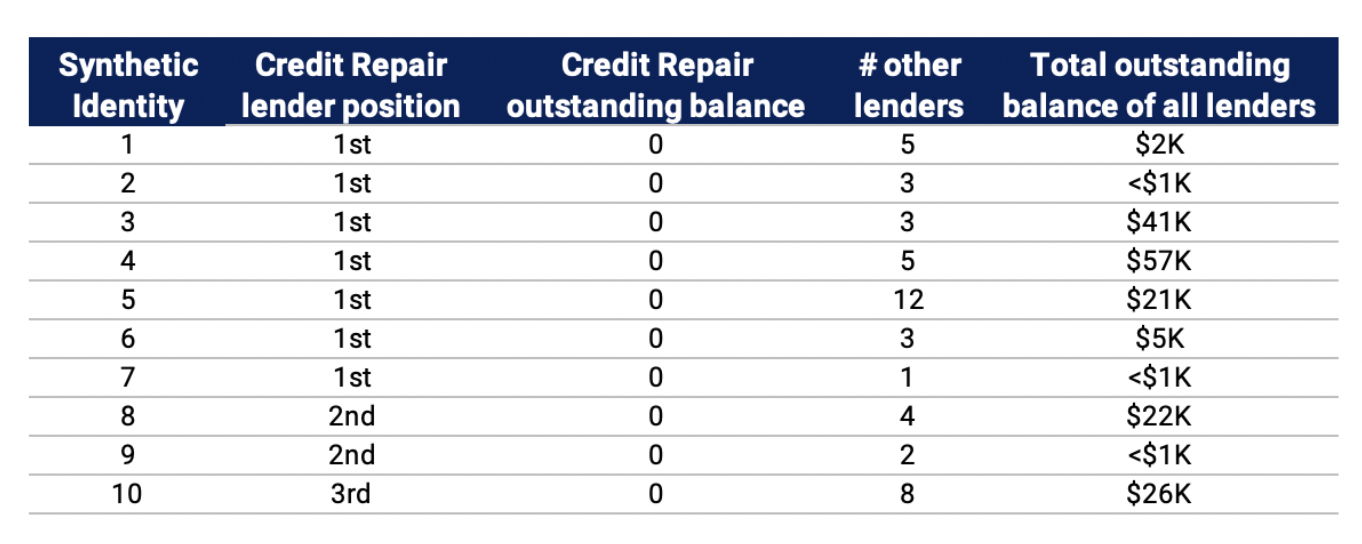

SentiLink analyzed the credit reports of 10 known synthetic identities where one of these types of credit repair companies had a tradeline listed on their credit report. The analysis looked at several things:

- Was the credit repair company the first tradeline opened?

- What was the balance on the credit repair company’s tradeline?

- How many other lenders issued credit to this synthetic identity?

- What was the total outstanding balance on all tradelines?

In 7 of the 10 identities, the first tradeline opened was with the credit repair company which suggests they were a gateway for these identities to boost their score and secure loans from other lenders.

In all 10 credit reports, the balance on the credit repair company’s tradelines was zero which likely signifies the fraudsters had no intention of using the credit issued.

It also indicates that the credit repair company bears little to no risk in approving these $5,000 unsecured loans for fraudsters as they aren’t used for credit, but for the improvement to credit utilization.

If this is true, there’s no incentive to incorporate strong identity verification checks when onboarding new customers at these types of credit repair companies.

Over 25 other financial institutions loaned money to these same identities. The total outstanding credit on all 10 identities was over $170K. The total outstanding credit on the 7 identities where the credit repair company was the first lender to approve the identity for a loan was $122K. If these types of credit repair companies were actively monitoring for synthetic fraud, they could prevent significant losses at other banks and lenders.

While not comprehensive, this analysis suggests that certain credit repair companies are specifically targeted by fraudsters to build the creditworthiness of their synthetic identities. If these same companies incorporate tools to detect and prevent synthetic fraud, it would significantly slow down the momentum of fraudsters which would lead to fewer fraud losses overall in financial services. This actionable measure to incorporate synthetic identity fraud detection would also ensure that credit repair companies focus on helping those that need credit the most.

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024