Blog post

Hidden Risk In Patient Financing - Synthetic Fraud

Sarah Hoisington

Published

August 25, 2020

Patient Finance 101

Point of sale financing has accelerated in recent years.

According to McKinsey, point of sale financing doubled between 2015 and 2019 and has taken 3% growth from credit cards and traditional lending models worth more than $10BB in revenues. IBISWorld predicts continued growth in this vertical, albeit at a slightly slower pace than the last 5 years.

Specifically, patient financing at point of sale is thriving. With 27mm uninsured Americans and average healthcare costs rising 5.5% per year, the Kaiser Family Foundation found that roughly 3 in 10 Americans have problems paying their medical bills.

Medical loans can be used to consolidate existing medical debt, pay for high deductibles, out-of-network charges, or elective procedures. Even necessary treatments such as root canals are sometimes considered elective or only covered at 50% on insurance plans. Many patients need financing to pay for these essential procedures over time.

Doctors and dentists who offer point of sale financing can build their practices while enabling consumers to get the medical care they need or want. The size of patient finance loans range from under $1,000 to over $40,000.

While point of sale patient financing is an opportunity for lenders and consumers, it also comes with the risk of synthetic identity fraud.

Synthetic Fraud In Patient Finance

A synthetic identity is one where the name, date of birth, and Social Security number do not correspond to a single real person. Synthetic fraud occurs when a synthetic identity is used to open bank accounts and apply for loans, credit cards, and many other related financial services accounts.

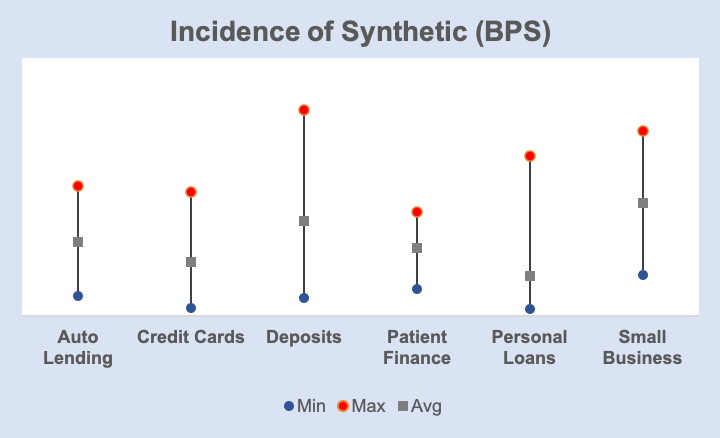

SentiLink has found the incidence of synthetic fraud in patient finance to be comparable to the amount detected in other financial service verticals.

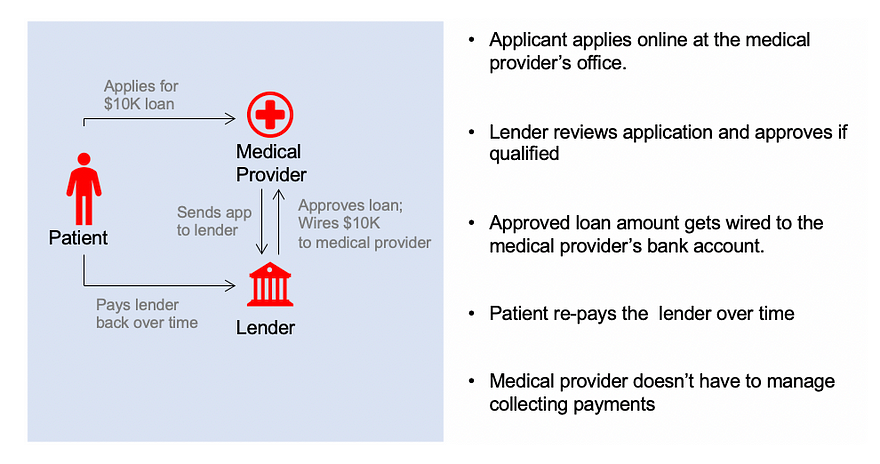

On the surface, committing synthetic fraud in patient finance doesn’t seem worthwhile for fraudsters. When a patient finance loan application is approved, the funds are wired directly to the medical provider rather than the patient. The patient does not receive the funds directly. Instead, they get their medical procedure and then repay the lender over time. In this scenario, the most a fraudster could get is a free medical procedure.

Follow the money — point of sale patient financing flow of funds

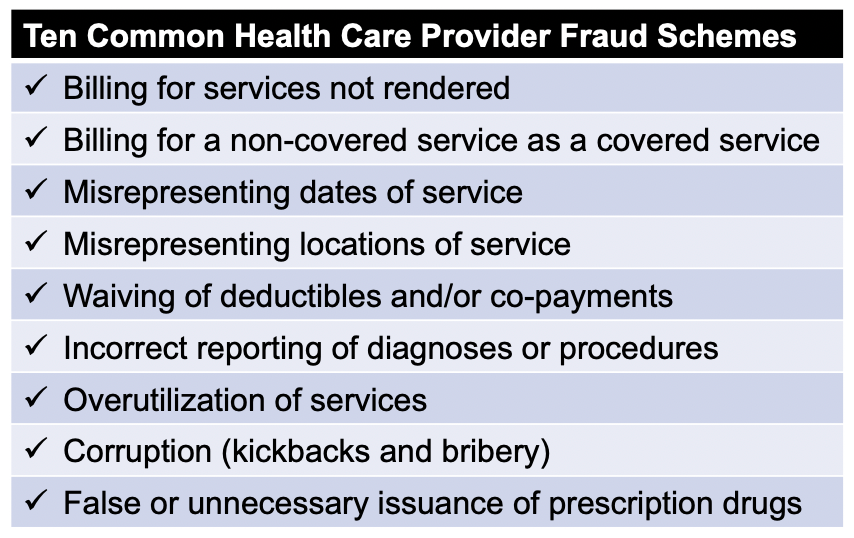

However, because of the way the money flows, the major risk to patient finance lenders is the medical providers themselves. These medical providers may collaborate with fraudsters to commit synthetic fraud or they may simply commit synthetic fraud themselves by applying for loans under the guise of patients who don’t really exist.

The National Health Care Anti-Fraud Association estimates conservatively that health care fraud costs the nation about $68 billion annually — about 3% of the nation’s $2.26 trillion in health care spending.

Losses Related To Synthetic Fraud In Patient Financing

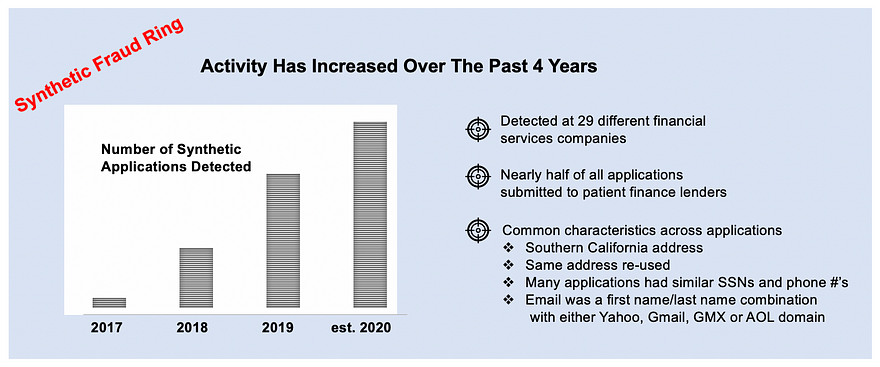

Losses can escalate quickly for patient finance lenders when medical providers are involved in synthetic fraud. Detecting synthetic loan applications early is paramount to mitigating loss. Consider an ongoing fraud ring detected by SentiLink that appears to be targeting patient finance lenders.

The fraud ring identified above is still active. Based in southern California, this ring re-uses similar Social Security and phone number combinations and a specific email syntax to attack almost 30 different financial services companies. Nearly half of all applications were submitted to patient finance lenders.

What’s unusual about this ring is the mix of first party and third party synthetic identities detected.

- First party synthetic identity is where the name and date of birth of the applicant refers to a real person, but the Social Security number is falsified

- Third party synthetic identity is where the name, date of birth and Social Security number combined create a fictitious person

The early applications detected with this ring were primarily first party synthetic fraud. The identities being used were derivations of the same first and last name with different date of birth and social security combinations. As this ring has evolved, there is an increase in 3rd party synthetic activity as many of the recent applications have used totally fabricated identities.

Monitoring for Provider Fraud

Proving provider fraud in patient finance after losses have already been realized is a time-consuming and expensive process. It often requires hiring outside legal counsel to conduct an investigation, subpoena medical records, and interview key employees.

Monitoring providers for key indicators of fraud before large losses occur can help minimize the damage. Below are two exercises for patient finance lenders to consider:

- Analyze applications within given medical providers to see if there are name, date of birth combinations that are tied to multiple Social Security numbers

- Analyze applications within given medical providers to see if there are different name and date of birth combinations for a given Social Security number

Focus on Synthetic Identities Mitigates Loss And Helps Reduce Consumer Costs

While patient finance is a space where synthetic identities are used, it’s not the only vertical targeted. In the case of the fraud ring above, applications with synthetic identities were detected at credit card lenders, consumer loan finance companies, and small business lenders. Because there is no victim that alerts a lender to fraud, losses from unpaid synthetic loans can accumulate over long periods of time, especially when medical providers are the perpetrators of the fraud.

Fraud in the patient finance is particularly complicated. A fraudulent medical provider rarely submits only fraudulent finance applications. Some medical providers operate honestly for years, but, for some reason, decide at a certain point to commit fraud. Other savvy medical providers involved in fraud know to intersperse fraudulent loan applications with legitimate ones, making it even harder for lenders to detect. Determining a fraudulent provider’s motivation, understanding whether they are colluding with others, or whether it’s just an employee of the medical provider committing fraud are all questions that often remain unanswered.

As for medical lending, the United States spends double the amount per capita on health care compared with other high-income countries. Efforts to mitigate costs related to health-care related fraud will ultimately help to bring these costs down.

Detecting whether synthetic identities are being submitted by certain providers can help bring clarity to some of these questions. Ultimately, addressing synthetic fraud in the patient finance space requires focused policies, targeted technologies, and controls to mitigate the risk of loss.

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024