Blog post

Check Fraud: New Predictive Signals to Fight an Old Problem

Seth Weidman, Product Lead, R&D

Product Lead, R&D

Published

June 2, 2023

Identifying new strategies to manage check fraud risk

Many of our partners have stated that check fraud is their largest fraud issue, with some losing tens of millions of dollars per year to this problem. This is consistent with broader industry views:

- A 2022 Association of Financial Professionals survey1 noted check fraud as by far the largest “payment” category where they saw fraud, with 66% of respondents saying their institution faced check fraud; second was ACH fraud at 37%.

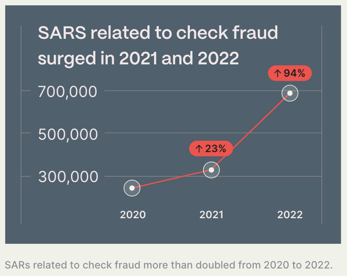

- Check fraud is growing quickly: SARs related to check fraud increased over 80% from 2021 to 2022, more than doubled from 2020 to 2022, according to FinCEN2.

Despite the economic impact of this problem, industry solutions to combat it are not nearly as well-developed as those that exist to combat other fraud problems, such as synthetic fraud or identity theft. One reason is a data issue: checking account screening companies, who are in the best position to offer data that could serve as the basis for such solutions, lack universal coverage and are highly susceptible to accuracy problems, particularly in cases of fraud3. However, we suspect a larger issue is simply that the industry has not looked into whether check fraud can be predicted by the presence of “artifacts” left behind by individuals’ previous participation in other fraud schemes. `

SentiLink’s early research into predictive signals

Based on the tens of thousands of check fraud labels we’ve received from partners, we’ve identified three signals that could be used to identify individuals who have an elevated risk of generating check fraud losses, based on their likely past participation in other fraud schemes: 1) Ties to likely-fraudulent PPP loans, 2) velocity of checking account applications, and 3) past history of committing synthetic fraud. Together, these signals flag 28% of check fraud losses while flagging 6-7% of an affected financial institution’s applications for checking accounts.

Ties to Likely-Fraudulent PPP loans

The Paycheck Protection Program was the largest small business rescue program in American history, giving out over $800B worth of loans between March 2020 and May 2021. Unfortunately, it was widely understood to have been riddled with fraud. The lenders that gave out the highest overall quantity of loans in the program were little-known fintechs who gave out many loans to individuals who may or may not have had real businesses in exchange for collecting hefty fees; such behaviors are detailed in the Congressional Report on PPP fraud4. The raw PPP data itself -- containing the 11.4M PPP loans -- has been made available thanks to a FOIA request5. In many cases, using the name and address on the loan, SentiLink is able to link the loans to individuals. Intriguingly, we found that individuals who got loans from one of the five lenders called out in the report have a 5-20X elevated risk of subsequently committing check fraud, commonly accounting for ~3% of an affected financial institution’s new account applications, but ~13% of the dollars lost to check fraud, and as high as 25% of the dollars lost for some individual fraud rings.

Why is getting a PPP loan from these lenders with minimal fraud controls predictive of check fraud? A report from the International Association of Financial Crimes Investigators, targeted at investigators focused on check fraud rings, describes how the same networks of individuals that commit check fraud were recruiting individuals to apply for fraudulent PPP loans:

Not only are accountholders being recruited to give up their debit card and PIN for check fraud, but accountholders are also being recruited for the use of their account relating to the recent CARES Act. Individuals are being recruited to fraudulently apply for Payroll Protection Plan Loans, Economic Injury Disaster Loans and fraudulent Unemployment Insurance claims. The funds are deposited to the accountholder’s bank account and the accountholder gives most of the proceeds to the recruiter. As with “crackin’ cards,” (the slang term for passing fake checks) individuals are recruited via social media to participate in these scams6.

Velocity of Applications for DDA Accounts

Individuals who commit check fraud may also participate in schemes that involve opening multiple checking accounts, such as money mule schemes7, or other kinds of first party fraud, such as ACH fraud (there are a very limited number of reasons for a legitimate consumer to have multiple checking accounts). While results vary widely across financial institutions, we have seen individuals who have applied for at least two checking accounts in the prior 120 days account for 7-11% of check fraud losses and just 1-2% of an affected financial institution’s applications for checking accounts.

Past History of Committing Synthetic Fraud

Dovetailing with our ability to detect synthetic fraud, we can identify individuals who are applying with their own, true identity but who have previously committed “first party synthetic fraud,” applying with their own names and dates of birth but with fraudulent SSNs. Such individuals account for ~9% of check fraud losses, compared to ~2% of an impacted financial institution’s applications for checking accounts.

Conclusion

These signals offer a novel approach to addressing check fraud by flagging individuals who have a highly elevated likelihood of having participated in past fraud schemes. Contact your SentiLink Partner Success Manager to learn how to evaluate these signals for your financial institution or even participate more deeply in the research itself.

1 "Payments Fraud and Control Report: Key Highlights." Association for Financial Professionals, 2022.

2 "FinCEN Alert On Nationwide Surge in Mail Theft-Related Check Fraud Schemes Targeting the U.S. Mail." Financial Crimes Enforcement Network, FIN-2023-Alert003, February 27, 2023.

3 "Account Screening Consumer Reporting Agencies, A Banking Access Perspective." National Consumer Law Center and the Cities for Financial Empowerment Fund, 2016.

4 "'We are Not The Fraud Police': How Fintechs Facilitated Fraud in the Paycheck Protection Program." Staff Report of the Select Subcommittee on the Coronavirus Crisis. December 2022.

5 Available at: https://data.sba.gov/dataset/ppp-foia

6 "'Crackin' Cards' 101: A Guide for the Investigator and the Street Officer." International Association of Financial Crimes Investigators, July 2021. https://www.iafci.org.

7 Money Mule Initiative 2021." US Department of Justice. Accessed at https://www.justice.gov/civil/consumer-protection-branch/money-mule-initiative.

Related Content

Blog article

April 3, 2024

Tips from a Fraud Fighter for Spotting Assumed Identity Abuse

Read article

Blog article

February 29, 2024

Reducing Complexity in Model Risk Management with Attributes

Read article

Blog article

January 18, 2024